Kela

During my previous studies, I used Kela’s online services. I received student financial aid and housing allowance, so I visited Kela’s website regularly to check benefit decisions and payment schedules. The online service was easy to use and gave access to all necessary information, such as accepted decisions, upcoming payments and application status. I also found that the application forms were clear and easy to fill in, and all required attachments were listed clearly at the end of the form. Logging in with bank credentials made it simple to handle matters without visiting a Kela office. Overall, I found the service user-friendly and helpful during my time as a student.

OmaKanta

I use OmaKanta regularly to view my lab results, doctor’s notes from appointments and to renew some of my prescriptions. As I have a chronic condition, I visit healthcare services several times a year. The OmaKanta service has been very useful, as it allows me to review important health information calmly at home whenever needed. It is convenient to have all records in one place, and the system makes it easy to follow up on my treatment and stay up to date with my health. Logging in is both safe and easy using my personal online banking credentials, which makes accessing the service straightforward and secure.

Keva

I logged in to the Keva online service to see what kind of information was available. However, there were no pension details visible for me yet. The only available option was to submit an application. I assume this is because I am still far from retirement age. Although I could’t view any personal estimates, it was still useful to explore the service and get an idea of how the information will be presented in the future.

Amazon vs. Verkkokauppa.com

I have used both Amazon and Verkkokauppa.com for online shopping. In many ways, they offer a similar user experience, such as a large selection, product reviews and the ability to compare prices. However, there are also clear differences.

Amazon is an international online marketplace where products are sold by both companies and private sellers. The selection is massive, but sometimes it is difficult to know who the actual seller is, and delivery times can vary. I always check the seller information and customer reviews carefully before ordering. Also, returning a product can be more complicated if it comes from outside the EU.

Verkkokauppa.com is a Finnish online store that I have used several times. I find it reliable and fast, and I like that I can trust the delivery times and product descriptions. I also feel more confident when dealing with a domestic company, especially if there are any issues with the product or delivery. Customer service is available in Finnish, and the return process is simple.

Although Amazon has a wider selection, I often prefer Verkkokauppa.com when I find the same or a similar product there. It supports local business, and I know I am protected by Finnish consumer laws.

Electronic Signature Services in Banking

One of the most useful digital tools in my work is the electronic signature service. We use it to send agreements and other important documents for signing. It makes the process faster, more secure and convenient for both the customer and the bank.

Before electronic signatures became common, customers often had to visit a branch or send signed documents by mail. Now, most agreements can be signed online using strong identification, such as online banking credentials. This has clearly improved efficiency and made the process smoother.

I use this service almost daily, and in my opinion, it is one of the best examples of how digitalisation has improved banking services. It saves time, reduces paperwork and helps move things forward more quickly for the customer.

Digitalization and the Digital Gap

Digital services are a part of everyday life for many people, but not everyone has the same ability or opportunity to use them. Some people don’t have the needed digital skills, devices or internet access. This creates inequality and can make everyday tasks more difficult for certain groups.

In my work in banking, I have seen that many elderly customers have trouble using online banking or electronic signature services. Some still prefer printed documents or handling matters by phone. Also, people with disabilities or limited language skills may find digital services hard to use without support.

The risk is that digitalization can make it harder for some people to take part in everyday services. This can lead to frustration, misunderstandings and delays, especially when other options are limited.

It is important to make sure that digital development is fair and includes everyone. In banking, for example, it should always be possible to offer personal service when needed. Clear instructions, easy-to-use platforms and support from staff can help reduce the digital gap.

Digital Competence Test

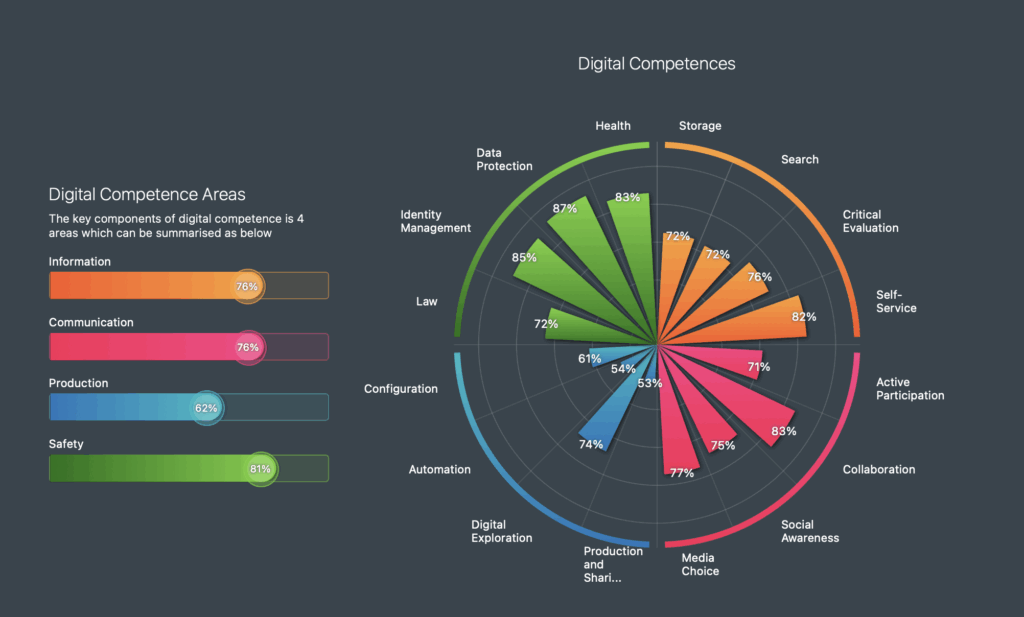

As part of this assignment I completed the Digital Competence Test. It helped me reflect on my current digital skills and identify both strengths and areas for improvement.

As shown in the image below, my strongest results were in data protection, identity management, and collaboration. These are especially important in my professional work, where secure handling of information and working with others through digital tools are part of daily tasks. The results confirmed that I have a solid foundation in using digital systems safely and effectively.

Self-Evaluation

This assignment made me think about how much digitalisation is part of both my work and daily life. I realised that I use many digital services without even thinking about it, such as OmaKanta and different online stores.

The task also made me think about the challenges some people face when they cannot use digital tools. In my work, I often see how important it is to offer support and alternative ways to handle things, especially for elderly customers.

Overall, the assignment confirmed that I have strong digital skills, but also reminded me of the need to stay updated as digitalisation continues to evolve.

I commented these blogs: