In today’s modern society, there are numerous digital services that play a crucial role. I couldn’t imagine functioning without these services—they greatly facilitate various tasks. Through online platforms, I can schedule doctor’s appointments, access my health information via Omakanta or private clinic apps, and review personal details such as my pension accumulation. Handling insurance applications, banking transactions, and similar tasks is also seamless online.

Digitalization has indeed transformed the way we interact with essential services, making them more accessible and efficient.

KELA

The Social Insurance Institution of Finland (Kela) is responsible for ensuring the basic security of individuals covered by Finland’s social security system in various life situations. Social security guarantees reasonable livelihood when it is threatened due to unemployment, illness, disability, old age, or the birth of a child and the loss of a guardian. It is the duty of society to provide adequate social and healthcare services for everyone. The right to social security is enshrined in the Finnish constitution.

The strategy of the Social Insurance Institution of Finland (Kela) is based on the principle: “Being there in life – supporting through changes.”

OMAKANTA

Kela provides a nationwide online service called OmaKanta, where individuals can access their health information around the clock. The service is maintained by Kela’s Kanta Services. To log in to OmaKanta, you can use online banking authentication or mobile authentication via the suomi.fi service, through which your personal information is transmitted to the Kanta Services.

In OmaKanta, I can review my health information, request prescription renewals, and check the results of laboratory tests. Additionally, OmaKanta allows users to create an advance directive for organ donation and specify their healthcare preferences. You can also act on behalf of a minor or another adult using authorization. Furthermore, OmaKanta provides EU COVID certificates for purposes such as travel.

Remember that if you use OmaKanta on a shared device, it’s essential to log out, clear your browser history and cache, and close all browser windows. This ensures that other users won’t have access to your personal information

KEVA – PENSION AGENCY

“Keva is Finland’s largest pension insurer, responsible for managing pension matters for various sectors, including local government, state, church, Kela staff, the Bank of Finland, and well-being regions. Another statutory task of Keva relates to reducing the risk of disability.

As an individual customer, you can check your work pension statement (työeläkeote) on Keva’s website. The work pension statement includes information about employment periods contributing to your pension, earnings, and benefits received during unpaid periods. In my case, there is no pension accumulation from work done before January 1, 2005, when I was under 23 years old. If I were to retire at this point, my pension amount would be quite small. You can estimate your own pension amount based on your personal information using Keva’s pension calculator. My minimum retirement age is 66 years and 3 months, although it has not been confirmed yet.

Omat eläketietosi -palvelu – Keva

DIGITAL SERVICES AND SHOPS

I use several different digital online stores and services daily or weekly. I order clothes and shoes from Zalando or similar online stores. I order food for home delivery through Wolt or Foodora. I can order a taxi through a taxi app, such as the Menevä taxi app. From the HSL and NYSSE apps, I can purchase local transportation tickets, from the VR app train tickets, listen to music from the Apple Music app, and listen to audiobooks from Storytel. For TV, I use Netflix’s digital service. In the store, I pay for my purchases with AppleWallet on my phone, where I can also store purchased train tickets, the S-Bonus card, and various other loyalty cards. Thus, I don’t necessarily need a physical wallet at all, as everything is available digitally.

Fortunately, a driver’s license will also be in digital form in the future. The Finnish Transport and Communications Agency Trafi is involved in the European POTENTIAL consortium, which is piloting the use of mobile driving licenses in the EU area. The Ministry of Finance has set up a project to guide the implementation of the national digital wallet. The technical implementation is the responsibility of the Digital and Population Data Services Agency. A digital wallet is an application that works on a phone and resembles a traditional wallet, particularly from the perspective of storing various types of information, such as a driver’s license. The user decides what information they want to store in the wallet.

The European Parliament and the Council approved the revised eIDAS regulation this spring 2024, which regulates the identification of individuals in cross-border transactions and trust services for electronic transactions. In the future, the regulation will also cover the European Digital Identity Wallet. The central obligation of the revised regulation is that member states must provide a digital identity wallet that meets the regulation’s requirements by 2026 at the latest.

More information:

Digitaalisen identiteetin lompakko tulee vuonna 2026 – Valtiovarainministeriö (vm.fi)

https://vm.fi/-/digitaalisen-identiteetin-lompakko-tulee-vuonna-2026

Digital solutions offer benefits such as efficiency, easier access to information, the development of various innovations, global connectivity, and improved services. On the other hand, not everyone has equal opportunities to access digital technologies, which can create inequality. Cybersecurity threats, such as cyberattacks and identity theft, are relevant in today’s digital landscape. While automation and digitalization may lead to job displacement, they can also create new job roles. Nowadays, we are significantly dependent on the digitized environment, and exposure to disruptions or other threats can be problematic. Additionally, not everyone possesses the necessary digital literacy or skills to use digital services effectively. Criminals also exploit AI solutions and digital technologies in their activities.

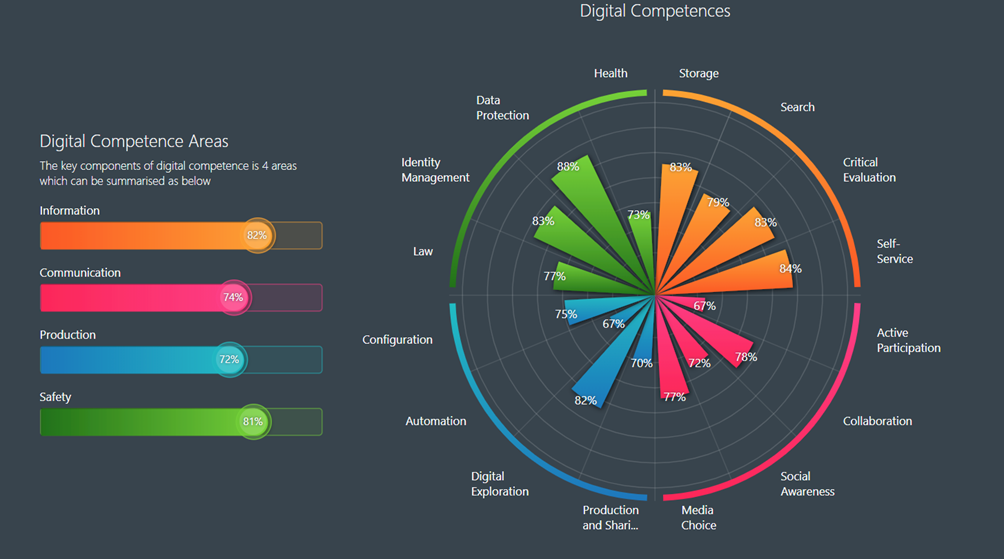

Digital competence test

I took a digital competence test, which assessed proficiency in various areas o digital fundamentals. I have ability to monitor and protect personal information online and understand consequences of personal digital footprint. Also I have ability to storage and protect sensitive data and understand related risks. Ability to being updated on the new digital technologies and opportunities. Not so intrested making myself visible in digital enviroments. I haven’t so much ability to create digital solutions to automate tasks.

SELF-REFLECTION

It was interesting to do digital compentence test. The test gave me different information about my skills. It was also interesting to explore various websites. Some of these sites were familiar for me, such as Omakanta and Kela’s site. Keva’s site was interesting also, because I haven’t use that site often. It was interesting to find out what my pension may be at the future.

PS. I already have the European Health Insurance card

My comments to the following blogs:

Tervetuloa blogiini | Mika’s site (savonia.fi)